Distance is an economic hurdle than can only be surmounted by world class infrastructure – roads, rail, port, airports, intermodal hubs and data superhighways. It is important to acknowledge that the South West’s regional centre is 185km from the world’s most isolated capital city. Quality infrastructure is therefore a supply chain facilitator of market access and enabler of competitiveness.

It is important to note that with much of business being digitally based then communications are as essential as traditional transport infrastructure. The South West’s relative global remoteness is mitigated by quality fibre connections and paves the way for attracting decentralised public and private workforces to a region featuring outstanding natural beauty and liveability.

The South West has a quality road network that has benefited from upgrades to the Collie Highway and Wilman Wadandi Highway (WWH) works with associated duplication of the Bussell Highway. The WWH boosts links with the 1350ha Waterloo Industrial area, Kemerton and the Bunbury Port. The new outer ring road will service the timber precinct as well as facilitating the smooth flow of traffic to the Capes.

A future bottleneck is likely to be the Busselton Bypass which will require duplication though to Vasse. The bypass will service Yalyalup Industrial Park close to Busselton-Margaret River Airport, connecting to south of Vasse and Carbanup in 15-20 years. Before that, the Vasse-Dunsborough link will require enhancement and additional works are likely to be needed on the main Forrest-Bussell Highway corridor. Extra passing points will be necessary on the South Western Highway.

The main Perth-Bunbury line (Claisebrook-Picton) line has been close to capacity for some time, particularly from Brunswick to Picton where freight from Worsley and Collie join the line to Bunbury Port and contribute to 40 movements per day. There remain limitations on containers and constraints due to the lack of standard gauge tracks (21-tonne axle loads). Long term growth at Kemerton would also benefit from a rail spur to service investment.

Investigations into the re-establishment of the Greenbushes rail line have been ongoing but challenged by mineral price volatility.

Bunbury-Perth passenger services will be restored by the end of 2025 with two new three-car Australind train sets. These will enter service at the same time the Armadale line is reopened.

The port operates across the Inner and Outer Harbours, although management of the southern section of the latter has been handed to the WA Department of Transport. This will free up land for integration into the Bunbury Waterfront project over the coming decade.

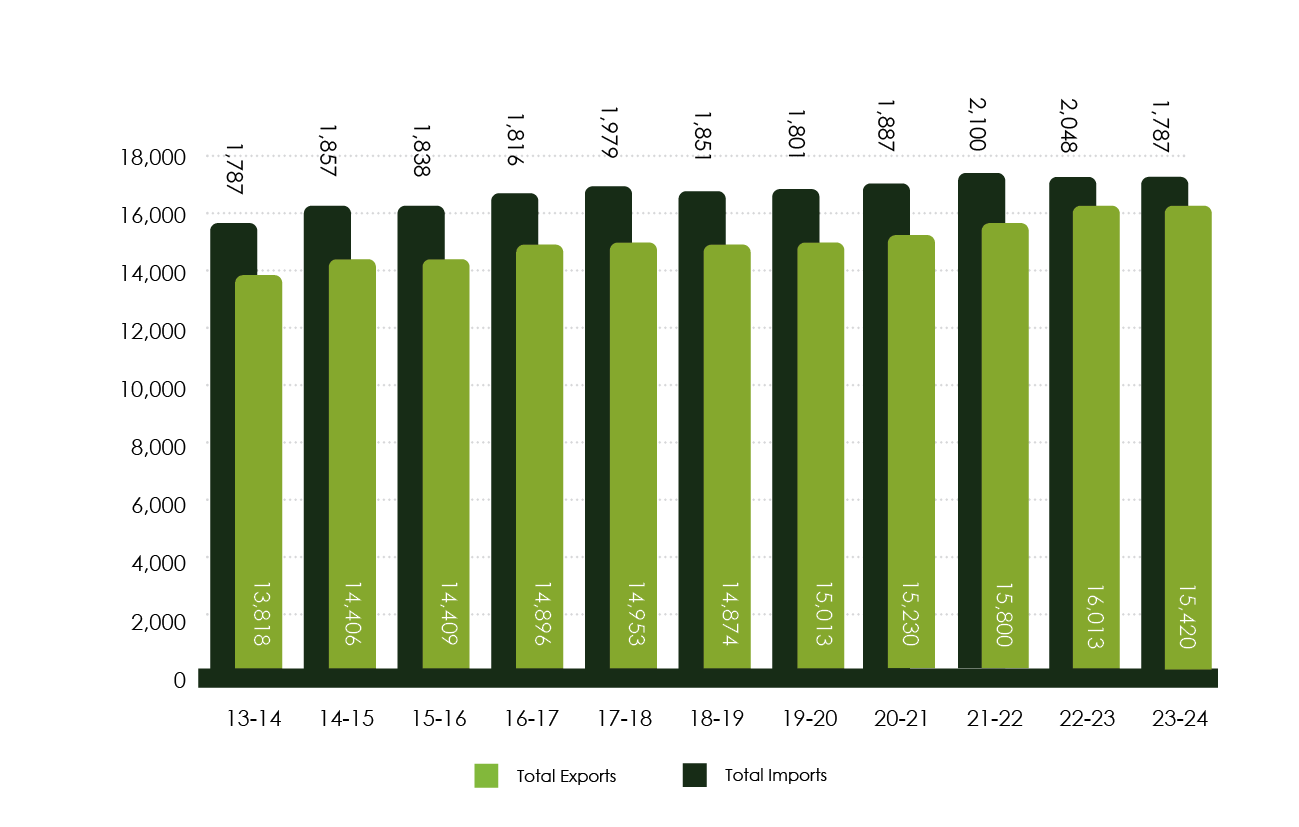

The Inner Harbour features 400ha of quality and available development land with potential to accommodate overflows from Kwinana and Fremantle. Bunbury Port has continued to meet regional trade demand since it was founded in 1864 and adapts to market changes. Current trade continues to be 17-18mtpa. Organic growth is expected in the years ahead.

While the Westport Taskforce recommendations on container options focused on Perth, about 30,000 TEUs (Twenty-foot Equivalent Units) are now generated in the South West each year. Pressures on the Western Trade Coast has maintained interest in Bunbury as a roll on/off (ro-ro) port, and several studies continue to focus on the future trade scenarios on the West Coast.

Regionally, the port has a critical role in facilitating trade and servicing the resources sector which produces the bulk of the region’s output wealth. With changing energy demands, the port is experiencing greater engagement with renewable energy projects and will continue to facilitate the future energy trade requirements for the region.

Figure 3 - Bunbury Port Throughput (‘000 tonnes) 2013-2024 | Source: Bunbury Port Authority ‘Bunbury Trade History’

BMRA aims to serve the region’s tourism potential as a powerful economic driver on the back of up to 250,000 passengers projected to pass through the BMRA in 2026. Those numbers will exceed the capacity of existing landside infrastructure and underpin the rapidly growing pressures to development a fit-for-purpose terminal.

The airport currently has 41 scheduled Fly in Fly out (FIFO) charter flights that service mine sites in the state’s Mid and North West, 3 direct services per week to Melbourne and 3 direct services per week to Sydney. The introduction of a tri-weekly Busselton-Perth service will encourage both domestica and international visitation. In 2023-24, a total of 156,095 passengers passed through BMRA. This number is forecast to reach 190,000 in 2024-25 when all the figures are in.

Additionally, the airport serves ad hoc charters, tourism operators, emergency services (DFES, RFDS) and a growing general aviation community. With BMRA’s close proximity to Perth, the regional facility is also an alternate airport for airlines when Perth Airport may not be available. Potential for the airport includes expanded destinations in Australia and overseas, serving passengers and freight. The airport benefits from extensive and nearby greenfield development opportunities which could serve freight as well as transport logistics, aircraft engineering and maintenance, and other industries.

Bunbury Airport has WA’s highest number of light aircraft movements after Jandakot in Perth. Bunbury services private aviators and supports three flying schools as well as the region’s rescue helicopter and seasonal water bombers. The site is home to more than 50 hangars and 100 aircraft. Expansion would require the realignment of the South Western Highway.

Manjimup Airfield caters for various aviation services such as the RFDS, emergency fire-fighting, private aircraft and has a small number of FIFO flights.

Coordinated by WA Treasury, the SWIS Demand Assessment estimates peak demand in the South West Interconnected System (SWIS) will more than triple by 2042. That means the South West could require up to 51GW of new energy generation and storage capacity to meet the needs of industry over the next 20 years. That will leave the South West with a serious energy demand deficit although 500MW of new grid-scale batteries are help balance supply and demand which is being challenged a lengthening demand period – and growth.

Batteries are also helping to stabilise the grid as Australians ‘electrify’ their homes.

With shortfall predicted, the reality is that if coal-fired power stations closures are firm, then there will need to be significant (and immediate) energy investment.

Collie is at the centre of the SWIS transmission network and has attracted multi-billion-dollar battery investments. These will help stabilise the grid and better manage solar. Domestic penetration of rooftop solar in WA is the highest in the world and it is expected to blow out to 50% by 2030.

The 2025 Electrical Statement of Opportunities report notes: “In 2027-28, following the closure of more coal-fired generation, more capacity will need to be procured … to avert energy shortfalls that are otherwise forecast to become more prevalent. While there is substantial continued interest in battery storage to help maintain reliable supply, investment in storage alone will not suffice. At least 110 MW of new generation sources such as gas, wind and solar generation will be required.”

The South West economy is dominated by manufacturing. Albemarle, South32, Iluka Resources, Tronox and Simcoa all have huge energy demands. Resolving the energy challenge is the leading issue in the region. It is unlikely that sufficiently scaled wind infrastructure will be producing energy before 2033-34. It is therefore increasingly urgent that projects are fast-tracked as soon as possible, along with an extended transmission line network to take best advantage of low population and consistent, clean wind opportunities.

The region also needs to look to green hydrogen. The WA Renewable Hydrogen Roadmap supports remote communities and fuelling vehicles, particularly in return-to-base operations such as mining and waste services.

Water security will be one of the region’s greatest challenges. CSIRO found that the South West was ‘one of the most water challenged’ parts of the country. Rainfall has declined 15% since 1975 and continues to see a contraction along a NW-SE axis towards Cape Leeuwin.

Agriculture uses about 60% of all water in the region and 185GL Wellington Dam (the State’s second largest surface water supply) is increasing in salinity. The dam’s salinity levels of 1,000-1,500 mg/L (WA Government) have resulted from clearing in Collie River East Branch and are well above the 500 mg/L total dissolved salts acceptable for potable water. It is also considered too high for sustaining irrigation. Industry leaders believe that water is under-valued and so users can be wasteful, particularly in industry.

The prospects for water security are concerning without significant investment. It is preferred that interventions are pre-emptive rather than reactive.

The South West is relatively well served by high speed communications, domestically at up to 100Mbps and in Business Fibre Zones at 1Gbps in Bunbury, Busselton, Margaret River and Collie. It is expected that technology advances, particularly with 5G Internet will boost a lot of areas, although fibre offers the greatest stability The five key functional telecoms drivers include: superfast broadband, ultra-reliable low latency communication, massive machine-type communications, high reliability/availability and efficient energy usage. (PWC 2020)

NBN Co set a world record long range 5G transmission in 2021. That record 1Gbps signal over 7km from a fixed wireless tower is now held by e&UAE’s 30.5Gbps set in 2025. Increases in fixed tower technologies will benefit South West due to a concentration of towers. That, Low Earth Orbit satellite progress and other advancements are critical to the region’s proposals to create a Digital Innovation District/Advanced Manufacturing and Technology Hub.